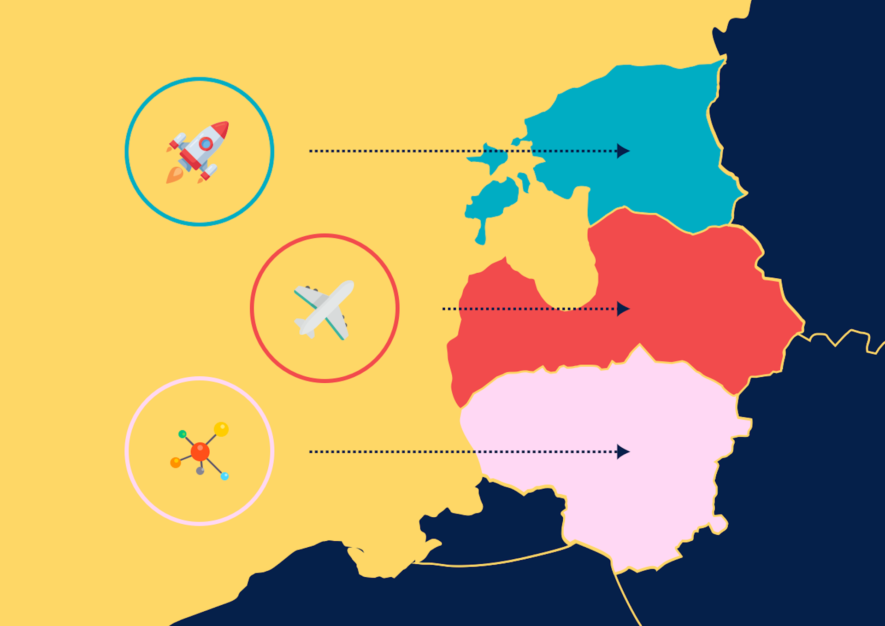

Export to the Baltics – guide to entering the Baltic market

The Baltic States are with a focus on innovation and an advantageous geographic location for trading with other major economic players such as the Scandinavian countries, Russia, Germany, and beyond. This makes Baltic States a very attractive export market for businesses both inside and outside the EU.

Due to close historical and cultural ties, and as EU member states and joint parties to many international treaties, the Baltics have a very similar business environment – to the point where they are often viewed as a single economic entity.

However, there are still some important differences in the details of their business and tax laws for businesses entering the Estonian, Latvian and Lithuanian markets to consider. Therefore, whether you are looking to expand your business activities to the whole of the region or wishing to choose the optimal location for your base of operations, here are some facts and figures to get you started.

Market potential in the Baltics

In 2017, Estonia, Latvia and Lithuania once again experienced rapid economic growth, and, while it is expected to slow down slightly in 2018, growth should still remain relatively high in the foreseeable future.

Investments and exports are rising along with wages and employment, which is increasing private consumption. Meanwhile, various local initiatives for boosting innovation as well as supporting new businesses and entrepreneurship should create ample opportunities and ensure continued growth. Here are some useful statistics to help you compare the three Baltic countries.

Doing business in Estonia

Estonia offers investors a strong and liberal economic environment with a positive outlook and a highly developed IT and telecom infrastructure.

According to data from the World Bank, Estonia ranked 37th in the world in terms of GDP per capita in 2016. At 9.4% of the GDP in 2016, Estonia has by far the lowest gross public debt in the EU. Third quarter estimates for Estonia’s real GDP growth for 2017 have placed it at slightly over 4% – the highest in the Baltics and well above the EU28 average of 1.6% – while current estimates for 2018 are around 3.2%.

Doing business in Estonia is an inspiring experience for sure. Estonia offers unique business opportunities with e-residency and other digital services. Estonia is making much effort to become the hub of new technology start-ups and highly skilled IT experts. If this sounds like your field, you will probably feel very comfortable setting up your company and starting your business in Estonian market. Estonian capital, Tallinn, is very close to Finland’s capital, Helsinki – this makes it easy to cooperate with Finnish.

In the global ease of doing business rankings, Estonia is currently ranked 12th. Meanwhile, on the 2017 Index of Economic Freedom scoreboard, Estonia ranks 6th – ahead of all other EU member states!

Baltic States Competitive Advantages

Doing business in Latvia

Doing business in Latvia is a good idea because Latvian market is geographically the centre of the Baltic States. Latvia is good logistical location to organize your trade routes.

In 2016, Latvia’s GDP per capita placed the country 44th globally (World Bank rankings). According to Eurostat, its public debt to GDP ratio for the same year was 40.6% (roughly half that of the EU28 average). Latvia’s GDP is estimated to grow by around 3.9% in 2017 and 3.4% in 2018. Latvia currently ranks 19th for ease of doing business and 20th for economic freedom.

While these indicators might be slightly beneath the other Baltic tigers, Latvia offers its own economic advantages, such as lower labour costs and slightly lower taxes (see below). Latvia’s capital, Riga, is also the largest city in the Baltics and the Riga-Moscow railway route offers the shortest and most direct connection with the Russian capital in the region. In addition, Riga International Airport is the leading Baltic air transit centre. Between 2004 and 2014, the airport’s annual number of flights increased by roughly 40,000, making it the fastest-growing air transport hub in the whole of Europe.

Doing business in Lithuania

Doing business in Lithuania is good idea because Lithuanian market is the biggest market of Baltic States by its inhabitants.

In terms of GDP per capita, in 2016, Lithuania was 36th in the world – directly above Estonia. Lithuania’s gross public debt in the same year was similar to that of Latvia: 40.1% of GDP. Meanwhile, current Lithuanian GDP growth estimates are 3.8% for 2017 and 3.5% for 2018. Currently, in 2017, Lithuania ranks 16th for both ease of doing business and economic freedom.

Lithuania is aiming to become the European hub of biotechnology and life sciences, and its population is one of the best educated among the OECD countries, in which Lithuania is noticeably ahead of the other Baltic States. In terms of infrastructure, Lithuania currently has the 12th highest internet connection speeds in the world (Latvia 29th, Estonia 40th) as well as the best roads in the region. Lithuania’s railway network also connects the Baltic region to China and Asia as a whole.

Tax law in the Baltics

Estonia, Latvia and Lithuania have each signed tax treaties with around 50 major countries across the world to avoid double taxation. While these treaties mostly overlap, the list is not completely identical and is constantly being updated. In addition to the tax treaty network and, of course, tax rates, another difference between the Baltic States’ tax laws is that Estonia has no regular corporate tax. Companies are, instead, taxed on their profits at the moment of their distribution (e.g. as dividends), while reinvested profits are completely untaxed! Latvia is implementing a similar system starting in 2018.

The main tax rates in Estonia (Estonian taxes) as of 2018 are as follows:

Corporate income tax: 0% (retained/reinvested profits) / 20% (distributed profits) / 14% (dividends paid to legal persons)

Withholding tax on dividends: Covered by corporate income distribution tax

Personal income tax: 20%

Social tax: 33% (paid by employer)

Funded pension payment: 2%/3%

Unemployment insurance: 1.6% (employee’s contribution), 0.8% (employer’s contribution)

VAT: 20%; reduced rate: 9%/0%.

Latvian tax law

The main tax rates in Latvia (Latvian taxes) as of 2018 are as follows:

Corporate income tax: 0% (retained/reinvested profits) / 20% (distributed profits)

Withholding tax on dividends: Covered by corporate income distribution tax

Personal income tax: Progressive: 20%/23%/31.4%

Social tax: 24.09% (employer’s contribution), 11% (employee’s contribution)

Micro-enterprise tax (see below): 15%

VAT: 21%; reduced rate: 12%/0%

Lithuanian tax law

The main tax rates in Lithuania (Lithuanian taxes) as of 2018 are as follows:

Corporate income tax: 15%/5% (small businesses)

Withholding tax on dividends: 0%/15%

Personal income tax: 15%/5% (certain self-employed)

Social tax: 30.98% (employer’s contribution), 9% (employee’s contribution)

Guarantee Fund payment: 0.2%

VAT: 21%; reduced rate: 9%/5%/ 0%

Estonian taxes, Latvian taxes and Lithuanian taxes are generally quite similar but there are some distinctions

It is worth keeping in mind that the above lists are not a complete overview of the local tax systems, some exceptions may apply and tax rates are constantly changing.

Business entity types in the Baltics

If you are considering to start Estonian company, Latvian company or Lithuanian company, you should first decide what kind of business entity would gain you the most. The most popular types of business entities in the Baltic States are the private limited company and the public limited company. As usual, and as the name implies, both types of company provide limited liability to the extent of the shareholders’ contributions.

Medium-sized businesses will find the private limited company more flexible, while larger businesses wishing to trade shares publicly must operate through a public limited company.

For a brief overview of the main requirements for setting up a public or private limited company in the Baltics, see the following table:

| Private limited company | Public limited company | |||||

| Country | Estonia | Latvia | Lithuania | Estonia | Latvia | Lithuania |

| Local name, abbr. | Osaühing, OÜ | Sabiedrība ar ierobežotu atbildību, SIA | Oždaroji akcinė bendrovė, UAB | Aktsiaselts, AS | Akciju sabiedrība, AS | Akcinė bendrovė, AB |

| Min. share capital | 0/EUR 2,5001 | EUR 2,8002 | 0/EUR 2,500 | EUR 25,000 | EUR 35,0003 | EUR 40,000 |

| Founders | At least 1 legal/natural person | At least 1 legal/natural person | 1-250 legal/natural persons | At least 1 legal/natural person | At least 1 legal/natural person | At least 1 legal/natural person |

| Management | General meeting of shareholders | General meeting of shareholders | General meeting of shareholders | General meeting of shareholders | General meeting of shareholders | General meeting of shareholders |

| Managers | At least 1 board member

| At least 1 board member

| At least 3 board members (optional) + CEO | At least 1 board member | At least 1 board member | At least 3 board members4 + CEO |

| Supervisory board | Optional, at least 3 members | Optional, at least 3 members | Optional, 3-15 members | At least 3 members | At least 3 members | 3-15 members4 |

1 Natural persons are not required to pay the share capital when starting company in Estonia if it is under EUR 25,000. Distributing dividends is not possible from Estonian company started of these terms until the contribution is paid.

2 At least 50% must to be paid prior to registering your company in Latvia, with the rest payable within 1 year.

3 At least 25% (but not less than the minimum) must to be paid prior to company registration in Latvia, with the rest payable within 1 year.

4 Lithuanian public limited companies must have either a management board or a supervisory board in addition to the CEO.

Latvian limited liability companies with up to five employees and an annual turnover of up to EUR 100,000 can also register as micro-enterprises, which benefit from a lower tax rate and only require a share capital of €1 to establish.

In Lithuania, it is also possible to found a “small limited liability company”, i.e. a Small Partnership (MB) with up to 10 members and no mandatory minimum share capital.

The CEO is the only legally responsible subject in the terms of business law in many countries. But this is not the case in Estonia and Latvia. The board members are the only legally responsible entities in Estonian and Latvian companies. The CEO does not have any legal responsibility for the company’s activities if she is not a board member of the company. It is worth keeping in mind when building up your subsidiary in Estonia or Latvia.

In each of the three countries, foreign companies can also set up a branch or representative office. It is, however, worth bearing in mind that these are not separate legal entities, i.e. the founder is liable for their activities.

Representative offices are only allowed to carry out non-commercial activities, such as marketing and market research.

Branches may also conduct business on behalf of the parent company, but are subject to the same laws and taxes as local companies.

In addition, EU-based companies can also relocate to the Baltics or merge with local companies without dissolving the company by registering as a European Company (Societas Europaea or SE).

The final step

Hopefully, this article will have helped you decide on the location for your new base of operations in the Baltics or inspired you to take advantage of the opportunities offered by the Baltic market. Once you have finished setting up your new Estonian company, Latvian company or Lithuanian company, the only thing left to do is to have your marketing materials, product descriptions, manuals and other necessary documents translated into the local languages. For that, you are already in the right place.

Transly Translation Agency provides quality translations from and into Estonian, Latvian, Lithuanian as well as many other languages. Our experienced, professional translators and editors are at your service, whether your translation needs involve marketing, IT, technical, medical, legal or other types of text.

Let us help give your business in Estonia, Latvia or Lithuania the final push on your path to success!

Check out these other posts from our blog

Contract translation – why choose a translation agency?

Export to Europe – guide to entering the European market